salt tax new york state

On April 6 2021 New York Gov. Scott is a New York.

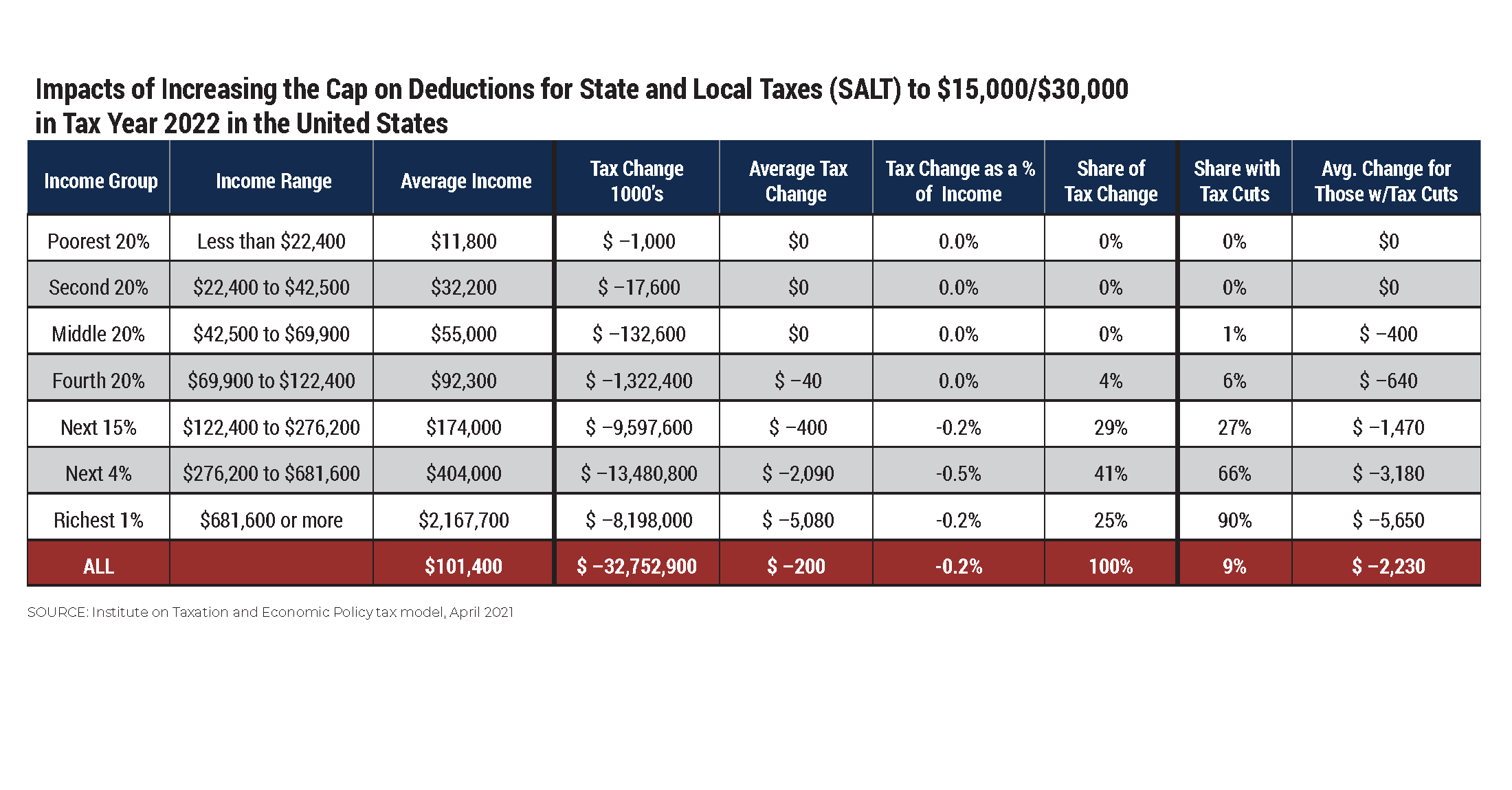

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The SALT cap limits a.

. Blue states like New York and California want to restore the unlimited state and local tax or SALT deduction. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Friday December 18 2020. Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap.

On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after. Whats worse is that the law.

16 2020 New York legislation was. The 10000 cap on state and local tax deductions for now may be here to stay however. The cap affects high tax states like New York.

According to WalletHub when you. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability. The Pass-Through Entity tax allows an eligible entity.

New York led a group including Connecticut New Jersey and Maryland in trying to strike down the 2017 limit known as the SALT cap which limits people to 10000 of their state. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. Legislation enacted by New York State will allow a New York City City partnership or resident S corporation to elect to be subject to a new 3876 entity level tax.

With the SALT limitation in place New. New York State and other states began to work on a solution to alleviate the effects. One of these provisions limits the Federal itemized deductions for State and Local Tax SALT to 10000.

The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. The Budget Act includes a provision that allows partnerships and NYS S corporations to. The SALT deduction is only available if you itemize your deductions using Schedule A.

The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returnsThe tax plan signed by President Trump. New York has issued long.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states. Before 2018 the SALT deduction was not limited meaning individuals could deduct 100 of the state and local taxes paid each year as an itemized deduction. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here.

An owner of the. For your 2021 taxes which youll file in 2022 you can only itemize when your. Bidens DOJ is trying to preserve the 10000 limiteven though.

The New York State NYS 20212022 Budget Act was signed into law on April 19 2021. Supreme Court has rejected a challenge from New York and three other states to overturn the 10000 limit on the federal deduction for state and local taxes which is.

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

State And Local Tax Salt Deduction Salt Deduction Taxedu

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

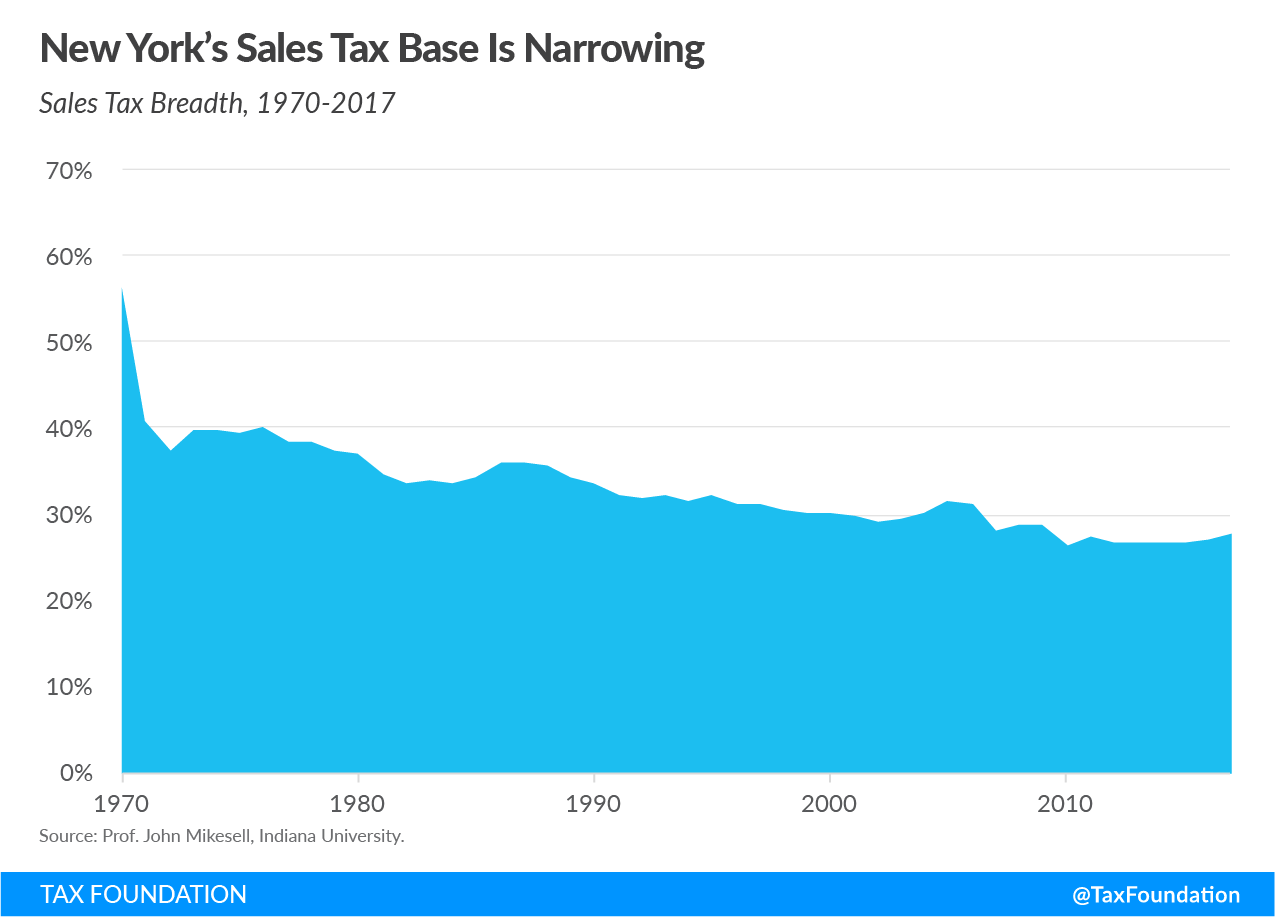

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Pass Through Entity Tax 101 Baker Tilly

Coping With The Salt Tax Deduction Cap Cpa Practice Advisor

How Does The Deduction For State And Local Taxes Work Tax Policy Center